Collapse incoming: Pope Francis orders

Holy See to transfer all assets to Vatican

Bank to protect the Church’s finances

September 21, 2022

Thousands of Amazon, UPS packages stolen

Biden planning to 'protect' us from cash – beginning Dec. 13

August, 2022

The Great Worker Shortage Is Causing Basic Services To

Really Break Down All Across America

December 2021

Federal Involvement in Health Care

'Doctors cannot question the federal government. That's how health care works in the United States right now.’

December 2021

![]()

Catherine Austin Fitts | Full Interview | Planet Lockdown

Dec 22, 2020

When YouTube censors this - and they will - and they did...

click on the photo below

This sit down interview with Catherine covers the spectrum of the current situation we find ourselves in. It was conducted as a part of the full length documentary. We are releasing the full interview for the betterment of public understanding of the situation.

Introducing the Council for Inclusive Capitalism with the Vatican

(note the calming piano music)

Capitalism lifts people out of poverty and powers global innovation and growth. But to address the challenges of the 21st century, capitalism needs to adapt. Through our commitments, actions and solutions, the Council for Inclusive Capitalism with the Vatican will create stronger, fairer, more collaborative economies and societies, ultimately improving the lives of countless millions of people across the globe.

Dec 7, 2020

Pope:Market capitalism has failed in pandemic, needs reform

October 4, 2020

83 Companies Linked to Uighur Forced Labor

Jan 14, 2021

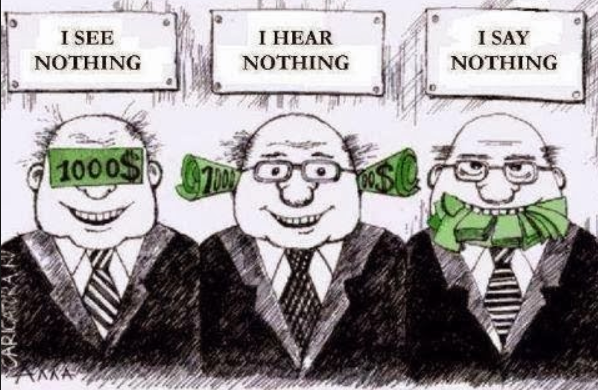

Major Central Banks "Have Totally Lost Control"

August 25, 2020

Yeah…...

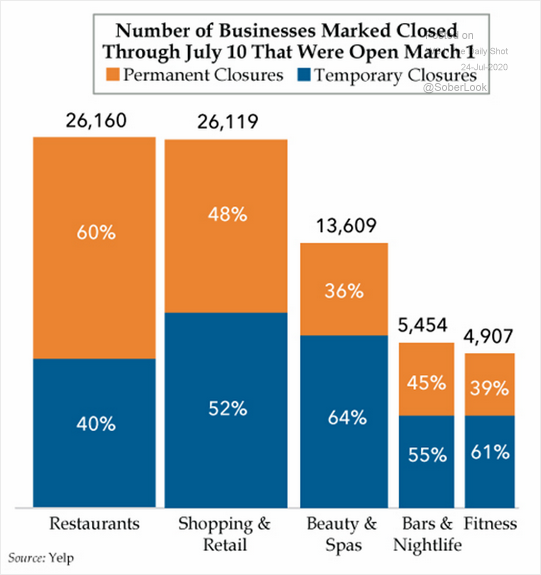

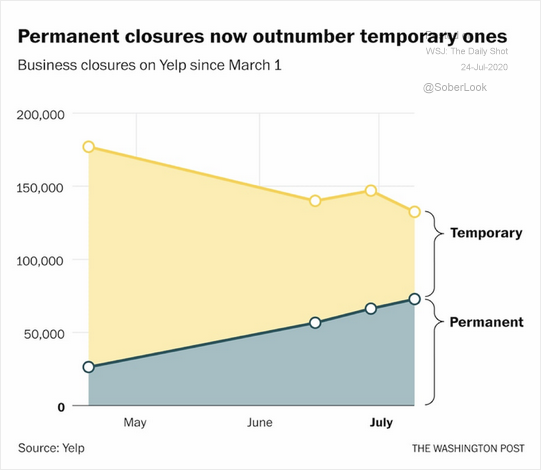

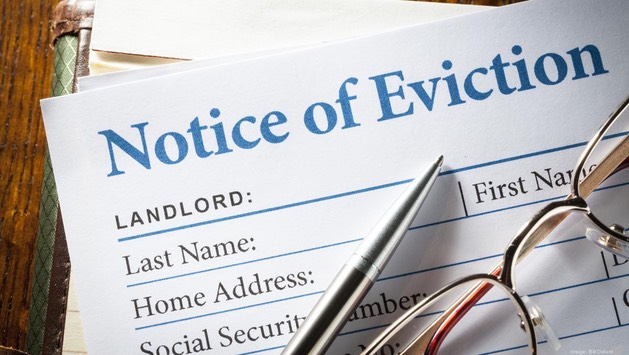

“Tsunami" Of Evictions Could Make 28 Million Americans Homeless This Summer Alone

With the pandemic continuing to sink its claws into the United States, economic conditions have also failed to improve for millions of people. As a result, nearly one-third U.S. households – representing 32 percent – have still not made their full housing payments for the month of July, according to a survey from online rental platform Apartment List.

July 12, 2020

FDIC Chairman Jelena McWilliams explains that the best place to keep your money is in an FDIC-insured bank.

R-i-i-g-h-h-t-t-t…….

Wonder why they felt this needed to be posted….

Pretty background piano music, though…;-)

March 24, 2020

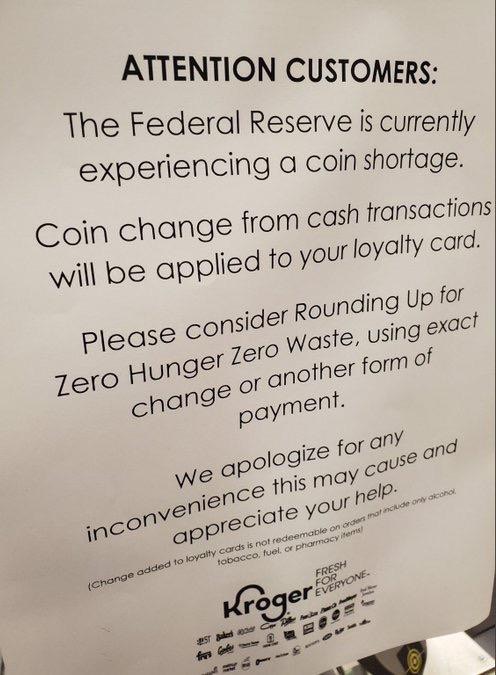

Cash Is Systematically Being Withdrawn From Banks

On the Way to a Digital Currency

June 24, 2020

Coronavirus Speeds Up the Move to Cashless Society

Jun 03, 2020

Boston Herald, by Froma Harrop: Last year seems a lifetime ago, but even then, cash was no longer king. The greenback had already lost its premier role as Americans’ medium of exchange in dollar terms. Plastic card and digital transactions had taken over. And that’s how stores, restaurants, and other businesses seemed to want it.

COVID-19 has accelerated this process for several reasons. Cash cannot change hands at a distance of six feet, and besides, who wants to grab that dirty bill? Sheltering at home means more purchases are being done over the internet.

The move away from legal tender was well on its way pre-virus. Some stores and eateries had stopped accepting cash altogether. If you’re a sandwich shop doing a brisk lunch business, processing plastic takes less time than waiting for someone to fish 55 cents out of their pocket. The restaurant chain Sweetgreen ran a stopwatch and found that cashless payments could be completed up to 15% faster than ones using paper money. That would enable businesses to hire fewer of what we used to call “cashiers.”

The Federal Reserve reports that debit cards are the most frequently used means of paying. Cash is employed in 26% of all transactions and 49% of those under $10. But every age group up through the baby boomers is doing more of them using digital means and plastic than cash. Not surprisingly, millennials lead the pack.

Despite these trends, a few states and cities have passed laws requiring businesses to accept cash, and here’s why: Some elderly people still don’t do technology. They don’t even have a cellphone, much less a PayPal account for transferring money.

Many poor people don’t have credit cards or even bank accounts. Some 6.5% of American households are “unbanked,” according to the Federal Deposit Insurance Corporation. Cashless establishments discriminate against this group.

The Pew Research Center found 29% of adults reporting that they made no purchases with cash during a typical week. But those making less than $30,000 a year were about four times as likely as higher-income Americans to say they make all or almost all of their purchases using cash.

Given that the average check price at the Dos Toros Taqueria was only $11.50, it seemed odd that the fast-food chain would attempt a nationwide ban on cash payment. But it did before reversing course when forced.

Some of us who are not poor prefer cash for valid reasons. Those wanting to control spending like it because psychologically, cash still feels like real money in a way plastic cards do not. Cash is anonymous, making transactions more private. That protects users from identity theft (though it makes them more vulnerable to pickpockets). Meanwhile, waiters, drivers and hairdressers seem to like cash tips.

For business owners, on the other hand, not having a lot of cash in the register deters robberies and saves them the trouble of hiring armored trucks. And they don’t have to worry about counterfeit money.

Cash has long been a medium for hiding criminal activities. The society that no longer uses it can better monitor drug dealers and tax cheats. The federal government in 1969 made the $100 bill the highest bank note obviously to force drug cartels to carry more bills, making them more detectable. The $500 bill, with William McKinley’s face on it, is no longer issued, as well as the $1,000 (Grover Cleveland) and $5,000 (James Madison) bills.

Of course, there’s nothing new about cashless societies. Centuries ago, peasants typically conducted transactions by bartering—say, trading two sheep for a straw-stuffed bed. Come to think of it, that wasn’t very sanitary during plagues, either.

Our Comment:

Going cashless may have benefits, but a cashless society also makes the control of buying and selling much easier.

Prophetic Link:

“And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.” Revelation 13:17.

Sam Zell: Fallout From Coronavirus Will Be "Worse Than The Great Depression”

Billionaire real-estate investor Sam Zell just became the latest bold-faced name to suggest that maybe - just maybe - the "V-shaped" rebound that investors seem to be anticipating probably isn't going to pass.

Instead, the real-estate investing legend, who earned his nickname "the Grave Dancer" buying up distressed properties in the 1970s, said he believes the economy has been deeply scarred by this experience, and is in far worse shape than it appears. Instead of a lazy summer boat ride, the US is in for a grueling slog back to growth.

May 5, 2020

18 Signs That We're Facing A Record Breaking Economic Implosion In 2020

May 5, 2020

US Stocks to See Worst Fall Since

1987 March 18,2020

They Are Telling Us That The Next Recession

“Won’t Be As Bad As 2008”. They Are Wrong.

![]()

Global Debt Hits $246 Trillion, 320% Of GDP, As Developing Debt Hits All Time HIgh

![]() May, 2019

May, 2019

Retail Layoffs Are 92 Percent Higher In 2019 –

And Now Even Wal-Mart Is “Quietly Closing Stores”-April 2019

As The Economy Teeters On The Brink Of Recession, US Debt Levels Are Absolutely Exploding Michael Snyder March 2019

![]()

These 8 Red Flags Warn Us We're Speeding

Toward An Economic Collapse Right Now

December 2018

U.S. Population Density Over Time

Today’s animated map, which comes to us from Vivid Maps, plots U.S. population density numbers over the time period of 1790-2010 based on U.S. Census data and Jonathan Schroeder’s county-level decadal estimates for population. In essence, it gives a more precise view of who moved where and when over the course of the nation’s history.

Note: While U.S. Census data is granular and dates back to 1790, it comes with certain limitations. One obvious drawback, for example, is that such data is not able to properly account for Native American populations.

Every Bubble In Search Of a Pin

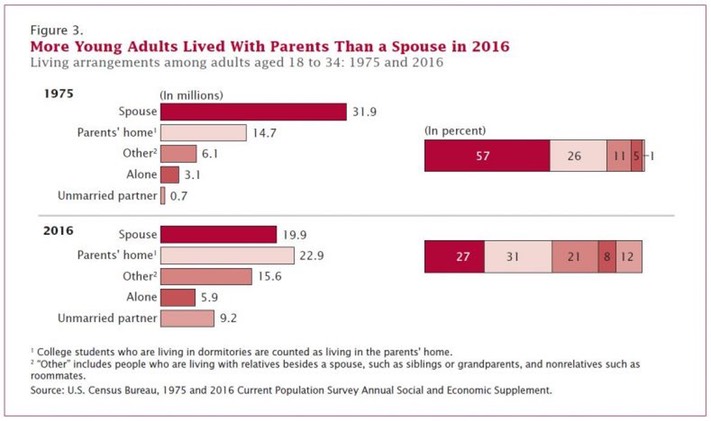

10 Numbers That Prove That We Are Rapidly

Becoming A Nation Of Government Dependents

and the fulfillment of Bible prophecy articles

When Debt Evaporates So Will Half the Global Population

Trader/analyst Gregory Mannarino says the next financial meltdown really takes off when we can no longer borrow money into existence. Mannarino explains, “There is a full blown debt crisis in Europe and in the United States. September 2018

The Dark Cloud Of Global Debt…

The Perfect Storm Looms

July 5, 2018

The Venus Flytrap Of Western Civilization:

Entitlements July 2018 ![]()

Death knell tolls for the euro as more

European nations repatriate gold ![]() March, 2018

March, 2018

This Is One Of History's Most Accurate Indicators Of A Looming Financial Crisis

Authored by Simon Black via SovereignMan.com - March 2018 ![]()

Is all of this just a crazy coincidence?

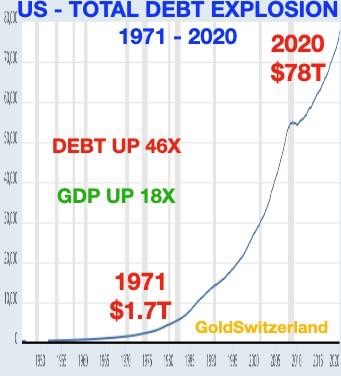

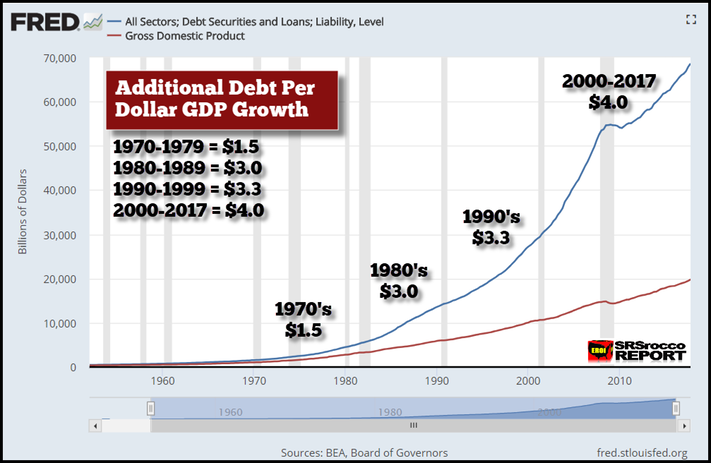

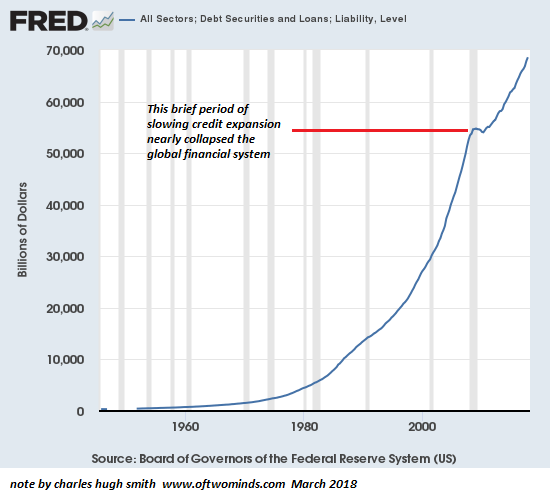

Total U.S. debt from all sectors is shown in BLUE while the U.S. GDP is in BROWN. You will notice that the total debt and GDP from 1950 to 1970 remained pretty even. It wasn’t until after 1970 did the debt increase more than the GDP.

America Is Heading Straight Toward The Worst

Debt Crisis In History Michael Snyder May 2018

Today, America is nearly 70 trillion dollars in debt, and that debt is shooting higher at an exponential rate. Usually most of the focus in on the national debt, which is now 21 trillion dollars and rising, but when you total all forms of debt in our society together it comes to a grand total just short of 70 trillion dollars. Many people seem to believe that the debt imbalances that existed prior to the great financial crisis of 2008 have been solved, but that is not the case at all. We are living in the terminal phase of the greatest debt bubble in history, and with each passing day that mountain of debt just keeps on getting bigger and bigger. It simply is not mathematically possible for debt to keep on growing at a pace that is many times greater than GDP growth, and at some point this absurd bubble will come to an abrupt end.

Today, America is nearly 70 trillion dollars in debt, and that debt is shooting higher at an exponential rate. Usually most of the focus in on the national debt, which is now 21 trillion dollars and rising, but when you total all forms of debt in our society together it comes to a grand total just short of 70 trillion dollars. Many people seem to believe that the debt imbalances that existed prior to the great financial crisis of 2008 have been solved, but that is not the case at all. We are living in the terminal phase of the greatest debt bubble in history, and with each passing day that mountain of debt just keeps on getting bigger and bigger. It simply is not mathematically possible for debt to keep on growing at a pace that is many times greater than GDP growth, and at some point this absurd bubble will come to an abrupt end.

Japan Is So Broke That Its Prisons Are Full Of 80+ Year Old 'Felons'

February 2018

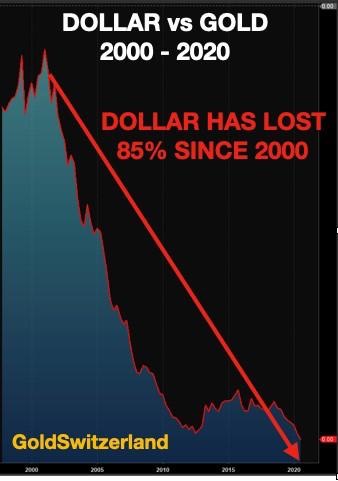

Financial writer Charles Hugh Smith sees one very big problem coming at us, and that is a dramatic loss in buying power of the U.S. dollar, but it’s not just the dollar. According to Smith, “All these currencies, there is nothing backing the currencies except the government’s force. That’s the yen, the euro, the dollar and the Chinese yuan. They are all going to have a catastrophic drop against real assets because they are all based on too much leverage, too much debt, too much money being pumped into the financial system that ends up in unproductive speculation. You can’t grow your debt at six times the rate of your economy. In other words, if you are creating $6, $8 or $10 of debt to eke out $1 of low productivity growth, you are dooming your currency, and all currencies are doing the same thing. All the currencies are going to take a big drop at some point . . . relative to real stuff. Real stuff is commodities we need: water, grains, food, oil, natural gas and, of course, precious metals.

Over The Last 10 Years The U.S. Economy Has Grown At

Over The Last 10 Years The U.S. Economy Has Grown At

EXACTLY The Same Rate As It Did During The 1930s May 2017

11 Facts That Prove That The U.S. Economy In 2017 Is In Far Worse Shape Than It Was In 2016 Michael Snyder

...the world is at an unprecedented moment in history where the interconnected nature of the global economy makes all players vulnerable to the mind-boggling volume of outstanding derivatives… ZeroHedge The love of money is the root of ALL evil. 1 Timothy 6:10

He gave a homeless man $100, then filmed the man to see how the money was spent. Jan 2015

Watch The Spread of Walmart Across The Country In One Startling GIF and

Why are They Preparing for a Major Earthquake on the New Madrid Fault?

Go to National and Global Financial issues archives